Plastics company and suppliers mix e-commerce platform and management savvy to make big supply-chain savings

Contents

Where the fat was

The backbone basics

How it works

Some needs made known

Where they're going from here

By Michael Lear-Olimpi, Managing Editor, Logistics Online

Geon, a global plastics-compounds company that operates from headquarters in Avon Lake, Ohio, recently cut some dead weight from its supply chain.

Thanks to an e-commerce initiative the company set up with seven of its key suppliers, 6 million pounds of dead weight – that's a six with six zeros after it – disappeared.

On the first day.

It wasn't just a loss on paper meant to impress bean counters, either. That weight represented 6 percent of carrying inventory in the supply-chain network at Geon, which will be renamed PolyOne in a merger with M.A. Hanna that's expected to be final later this year.

And that reduction was through just one of seven suppliers. Other savings achieved through the e-supply chain effort, for instance, have uncoupled 40 rail cars, at an annual cost of about $10,000 in demurrage each, from the cost train.

and their customers are complex and involve large volumes of

product. The e-commerce supplier network that Geon has set up

is taking excess inventory, and costs, out of the supply chain.

But that's just the beginning. Geon's goal is to continue dropping excess weight and build supply-chain muscle. Ultimately, Geon, which also makes plastic pallets, wants to expand its network to offer these efficiencies to customers, and their customers – all the way down the supply chain, and to turn its logistics operation into a true partners-based value chain.

Where the fat was

The slashed inventory was safety stock, produced primarily because spinning off a unit and making it a supplier of resin for polyvinyl chloride (PVC) production forced Geon to create two disparate enterprise-resource planning (ERP) systems for supply, according to David C. Honeycutt, director of e-business for Geon.

It took just 12 weeks to set the system up and tighten supply-chain links at 14 Geon facilities that handle plastics compounds. Now, Geon and its seven suppliers are plugged into a three-pronged business-to-business supply-chain management platform that allows clear, end-to-end supply-chain visibility.

That split was a good move, but it obscured the ends of Geon's supply chain, blurring them in some cases like train-track rails merging in the distance.

Material-forecasting efficiency decreased and that was bad news, considering the company's demanding forecasting and production needs.

So, Geon — with help from Andersen Consulting and webMethods, a software company whose core competency is making efficient e-commerce happen — designed its e-commerce platform.

webMethods and Andersen souped up Geon's enterprise systems and put procurement on the fast track to streamlining by allowing supply-chain partners to link information systems over the Internet seamlessly to Geon's e-commerce structure. It took just 12 weeks to set the system up and tighten supply-chain links at 14 Geon facilities that handle plastics compounds (this will be more facilities when the Geon/Hanna merger is finished). Now, Geon and its seven suppliers are plugged into a three-pronged business-to-business supply-chain management platform that allows clear, end-to-end supply-chain visibility.

The result: Geon has significantly cut order-management and inventory costs and activities; its suppliers are hiking productivity and lowering procurement costs.

Geon has significantly cut order-management and inventory costs and activities; its suppliers are hiking productivity and lowering procurement costs.

The companies said that the Geon-suppliers project is the first in the plastics industry connecting all players to the supply chain in real time.

It's saving time, money and effort, and has taken a load off of managers' shoulders, and off the bottom line.

Back to top

The backbone basics

Geon's e-commerce platform has three planks:

- GeonB2B. This is the integrated business-to-business e-commerce platform that links Geon to customers and suppliers.

- www.GetGeon.com. This Web portal is an e-commerce site connected to Geon's ERP system. It enables customers to submit orders, check order status and perform other order-management operations.

- www.Geon.com, Geon's new corporate Web site, which provides key technical and product information, including literature for customers.

Honeycutt explained the essential reckoning behind the e-supply chain platform.

"The primary reason we sought this connectivity was to capture the end-to-end efficiency when demand visibility is maximized," he said. "We tell our suppliers what our demand is by sending a rolling 400-day forecast. They can use that data to optimize their production schedules. Net impact is in several areas."

Besides reducing overall inventory by up to 10 percent and unhinging money for working capital since it went live, Honeycutt said the partners expect the network to extend its value by reducing errors and stockouts, and by reducing the need for administrative order-placement staff, who can be used elsewhere.

Back to top

How it works

Honeycutt, who has been with Geon for 10 years and who handles a toteful of responsibilities — from e-commerce and customer-relationship management to marketing to Web development —laid out how the system works for Geon and its supply-chain partners.

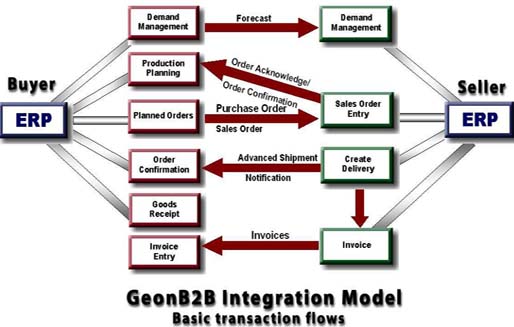

The flow of information steering so-called direct materials — raw materials like resin, fillers and additives used to make polyvinyl chloride compound — goes this way (see Figure 1 for a flowchart of the Geon B2B integration model):

- A customer creates an order for compound on the GetGeon Web site (or an order is generated through Geon's automatic vendor-managed inventory [VMI] channel).

- Demand for material is then updated automatically in Geon's ERP system.

- The manufacturing resource planning (MRP) process then runs in batch mode in the evening and generates purchase orders, based on the bill of materials. It then sends the purchase orders to suppliers.

- Besides transactions being kicked off through MRP, Geon planners can also manually create orders in the company's ERP system, which will send purchase orders to suppliers in real time.

- The transactions the system has handled are then sent over the Internet in XML format to the partner's ERP system. That's when Geon's demand is automatically converted into a sales order, with the system automatically checking for availability. Once the sales order is complete, the system triggers an order confirmation and sends it back to Geon.

- Through the order life cycle, other transactions flow between Geon and partners, including advance-shipment notices, rail-car sightings, invoices, lead-time synchronizations and forecasts.

Back to top

Some needs made known

The system required a server running Windows NT with the webMethods B2B server, Microsoft's SQL server and some custom Java components installed. Besides that, Geon used information-technology infrastructure on hand, such as its network, firewall, ERP and other components. To make it work, and find webMethods, Geon needed an integrator, Honeycutt explained.

"Prior to the creation of the joint venture with OxyVinyls, Geon's portion of this joint venture — the PVC-resin production — was run on the same instance of SAP as Geon's compound business," Honeycutt said. "The joint venture forced us to create the two disparate SAP instances, which caused the disconnect in the supply chain. We asked Andersen Consulting to help us with a methodology/technology to reconnect these SAP instances, and webmethods was brought into the fold."

"The primary reason we sought this connectivity was to capture the end-to-end efficiency when demand visibility is maximized. We tell our suppliers what our demand is by sending a rolling 400-day forecast. They can use that data to optimize their production schedules. Net impact is in several areas."

-David Honeycutt, Geon

Implementation went smoothly, and savings were immediate throughout the supply chain — in warehouses and factories, in transportation and safety stock. The powerful know-how and abilities of Andersen and webMethods were key in helping Geon to consolidate project phases and get it running fast. Just six months passed from the time Geon managers came up with the idea of creating the connection until it went live. Half of that time — 12 weeks — was devoted to implementation once the necessary equipment, partners and personnel were in place. More total time is often devoted to selecting technology or advising partners, let alone taking an enterprise e-commerce system live.

Honeycutt explained that Andersen Consulting is Geon's long-term consulting partner and advised the company in developing its overall e-commerce strategy. Andersen also helped Geon define, configure and deploy procedures, systems and processes to achieve corporate goals. The consultants have also been instrumental in helping Geon to roll its new platform out to key trading partners – Millennium Chemicals, Rohm & Haas and Crompton Corp., along with OxyVinyls.

Honeycutt stressed that much of the process of setting the platform up and making it work was headwork.

"The conception phase is hard to define in terms of weeks, because we were just trying to figure out what to do," Honeycutt said. "We did this over a period of approximately 12 weeks, but it was not necessarily 12 weeks of work."

Geon invested about $1 million in the effort and expects in-house return on investment of 50 percent to 90 percent, Honeycutt said.

Implementation went smoothly, and savings were immediate throughout the supply chain — in warehouses and factories, and in transportation and safety stock.

Somewhat remarkably, the system cost no jobs, but increased personnel efficiency by freeing up supply-chain and order-management workers to handle what Honeycutt described as more challenging problems than routine order entry.

Back to top

Where they're going from here

Honeycutt said Geon managers and supply-chain partners expect the system to build momentum. For instance, he projected about 20,000 purchase orders a year –around 70 percent of Geon's raw-material buying for PVC-compound operations. All relevant transactions — confirmations, invoices and such — are expected to hit about 150,000 a year, Honeycutt said.

Honeycutt declined to say whether it costs anything to become a member of the company's e-commerce supplier network, but he said it's "fairly easy to hook up new partners." Prospective partners must be Internet-able, capable of running Windows NT and the GeonB2B architecture, have a compatible firewall configuration and, usually require only a "slight modification" or addition of business logic to their ERP system so that they can handle automatic e-commerce transactions.

"The team has developed a ‘repeatable' process for implementation and has proven that GeonB2B can be deployed in 6 - 9 weeks," Honeycutt said.

That kind of flexibility is good for the plastics-supply and –manufacturing sectors, and for big-business supply-chain partners.